“Along with relationship break-ups and the loss of a loved one, moving house is frequently cited as one of life's most stressful events.”

Benenden Health

Yes, sure your estate agent will be on hand throughout, but they can only do so much. The sooner you get your surveyor involved in the process, the better. Because their knowledge is not limited to just doing your survey. Our RICS Chartered Surveyors can help you with invaluable insight and guidance throughout the purchasing process:

Risk mitigation

Surveyors can help buyers understand the potential risks associated with a property, such as flood zones, easements, or encroachments. By identifying these risks early on, you can make informed decisions and mitigate potential future liabilities.

Legal compliance

Surveyors are familiar with local zoning laws, building regulations, and regulations governing property transactions. They can ensure that the property complies with legal requirements and advise you on any necessary permits or approvals.

Accurate property measurements

Our surveyors use advanced tools and techniques to accurately measure and map properties, including boundaries, easements, and topographical features. This information is essential for determining the property's true size and boundaries.

Negotiation support

Armed with a surveyor's report, you can negotiate with sellers based on objective data regarding the property's condition and value. This can give you leverage in negotiations and help you to secure a fair deal.

Peace of mind

Getting a professional surveyor's opinion gives you confidence in your property buying decision. Surveyors provide an independent, unbiased assessment of the property, giving you peace of mind that you’re making a well-informed investment.

Long-term investment protection

Investing in a property is a significant financial commitment. A surveyor's report can help you to avoid costly surprises down the line by identifying potential issues early on and allowing them to address them proactively.

We work with more than 200 lenders across the country and are the chartered surveyor of choice for leading estate agents nationwide, so we’re also already well-connected.

Find out more about us, what makes us award-winning and how we’re RICS accredited here: 10 reasons why you should choose Arnold & Baldwin Chartered Surveyors

Your six-step guide to buying a house

As industry experts, our insight and knowledge can help at every stage of the procedure for buying a house – that’s why we’ve put together this handy guide. Some of it will seem like common sense and much of it you can leave to us when you do get to putting in an offer on the home of your dreams. But just understanding the steps to purchasing a home can help to take a lot of the stress out of the process.

Arnold & Baldwin’s step-by-step guide to buying a house

Decide your budget

Find your place

Choose your new home

Make an offer

Arrange your mortgage

Get a survey

Start the sale process

The moving home process: Our super seven-step guide

1. Decide your budget

Whether you’re a first-time buyer, upsizing or downsizing, knowing what you have to work with in terms of budget is the best place to start. Your new house price range will depend on a number of factors like your deposit, how much equity you have in your current property if you have one, and how much you want to borrow.

Getting some financial advice and an indication of a mortgage offer is a good place to start and will help to guide your property search.

2. Find your place

Choosing where to live is perhaps the decision that influences all others. If you get this decision wrong then you will either be unhappy in your new home because you don’t like the area in which you live, or you will face the costs of moving again, perhaps sooner than you’d planned.

So, question one: stay where you are or explore new horizons? You may already know where you want to live and why, but it’s worth taking the time to explore your local area or further afield. For example, take a fresh look at areas you may have ruled out. They could be up and coming, meaning you can get more for your money. Or if you want to move to another area or to a completely different part of the country, doing your ‘homework’ is essential. Make it fun by taking a few trips to your desired locations.

Think about what is important to you. Do you want the peace and quiet of a small village in the countryside? Or does the hustle and bustle of a town or city appeal? Look at the local area and amenities. Do they live up to your expectations? Consider local schools because, even if you don’t have a family yet, it may become an important factor before you know it!

If the home seller has purchased one of our ReadyData expert reports, you’ll be able to see at a glance details about the location you want to live in, including everything from conservation areas to broadband coverage, schools info, rail and road noise and aircraft landing sites.

3. Choose your new home

Once you’ve found your perfect location (or two!), it’s time to take a look at property types and get to know the local market.

Rightmove and PrimeLocation are two great places to start your search from the comfort of your sofa.

These websites contain millions of properties all over the UK so you’ll get a good overview of property prices in areas you’re interested in. Excellent search functionality also means you can also narrow down by property type, number of bedrooms and/or price range. Limiting the number of properties in search results can be a good idea and reduce the potential for search fatigue!

It’s also a great idea to use the local estate agent. Their local knowledge is invaluable, they’ll have a good understanding of what represents good value for money, and they are best placed to show you around.

Visiting as many properties as possible in your chosen area is essential to getting a good feel for what you like and don’t like.

Don’t limit yourself to only viewing houses that you like the look of online as you can only really get a feel for a place when you visit in person.

Also, view properties that you may not necessarily be drawn to but that fit your requirements for the number of rooms, size of the garden, location, etc. You may feel very differently once you set foot in the door.

Another thing to think about that is very important is whether the property is freehold or leasehold. If the property is leasehold, check the length of the lease and how many years are left on it. If there are less than 80 years remaining, it could be very costly for you to extend and may make selling in the future a problem.

If you need some advice on the lease extension process, find out more here and get in touch. We can help with that too.

4. Make an offer

Found your dream home? It’s time to make an offer!

You should do this in consultation with the estate agent and by gathering as much information as you can about the property. All this knowledge will help you to make a solid offer, negotiate or make a counteroffer if needed.

There are many reasons beyond your control why your offer may or may not be accepted, from the vendor’s circumstances to if there are other interested buyers.

You may also be asked to pay a small holding deposit to show that you are serious. You should get this back if the sale falls through.

If your offer is accepted – congratulations! However, there’s still a little way to go before the deal is done. The next and most critical stages are here!

5. Arrange your mortgage

It’s time to dot the i’s and cross the t’s on your financial arrangements.

Make an appointment with your bank or an independent mortgage broker who can review your offer, compare the mortgage market and find a product that is suitable for you and your budget.

Once you have chosen the product best suited to your needs, your broker will submit your paperwork and await acceptance from the lender.

As well as all your earnings and eligibility information, the lender will ask for a valuation to be carried out to ensure the property is suitable for lending purposes and the price paid is in line with the current market.

At this stage, it’s worthwhile to remember that the valuation is just for the lender’s benefit and to protect their investment.

So, it’s worth checking out your options and upgrading this valuation to a RICS Homebuyers Surveyor Building Survey. A survey will give you more clarity on your buying decisions and help to identify any pitfalls or work that may need done. You don’t want to be surprised a year or two down the line with the huge expenditure of a new roof or complete rewire. It’s worth knowing the potential risks and if the survey does reveal any issues, you have stronger negotiating power.

Visit Our Services to understand the differences between the surveys and the valuable information they include.

If you wish to discuss your purchase in greater detail, please feel free to call us. We’re happy to advise on which survey our experts feel is most appropriate for you.

As honest, approachable experts we never upsell - and we’re always happy to help!

As far as timelines are concerned, typically the estate agent will receive a phone call to arrange the mortgage valuation within 7-10 days of submitting your application.

6. Get a survey

Your accepted offer is, of course, conditional on your valuation reflecting the price you’ve offered.

But don't look at the cost of a survey as wasted money. To be forewarned is to be forearmed. That means a home, building or property survey can protect you and your investment.

If there are any problems, you can use the information in the survey to renegotiate the purchase price or insist the seller gets the work sorted out before you proceed with the purchase.

For example, if you view a property and you get a sense that there may be damp, roof issues, subsidence, dry rot, woodworm, asbestos, central heating or electrical issues, you’ll need a survey – check out one of our latest insights on this topic:

8 reasons why you need a home property survey

It’s important to remember that your mortgage lender’s valuation report is not a survey. It merely tells your lender whether or not the property is reasonable security for your loan.

It's always better to be informed and if you want to avoid the pitfalls relating to buying a property, instructing a RICS (Royal Institute of Chartered Surveyors) survey is a must.

If you’re unsure, just ask us.

Arnold & Baldwin recommends:

Best type of survey for home purchase:

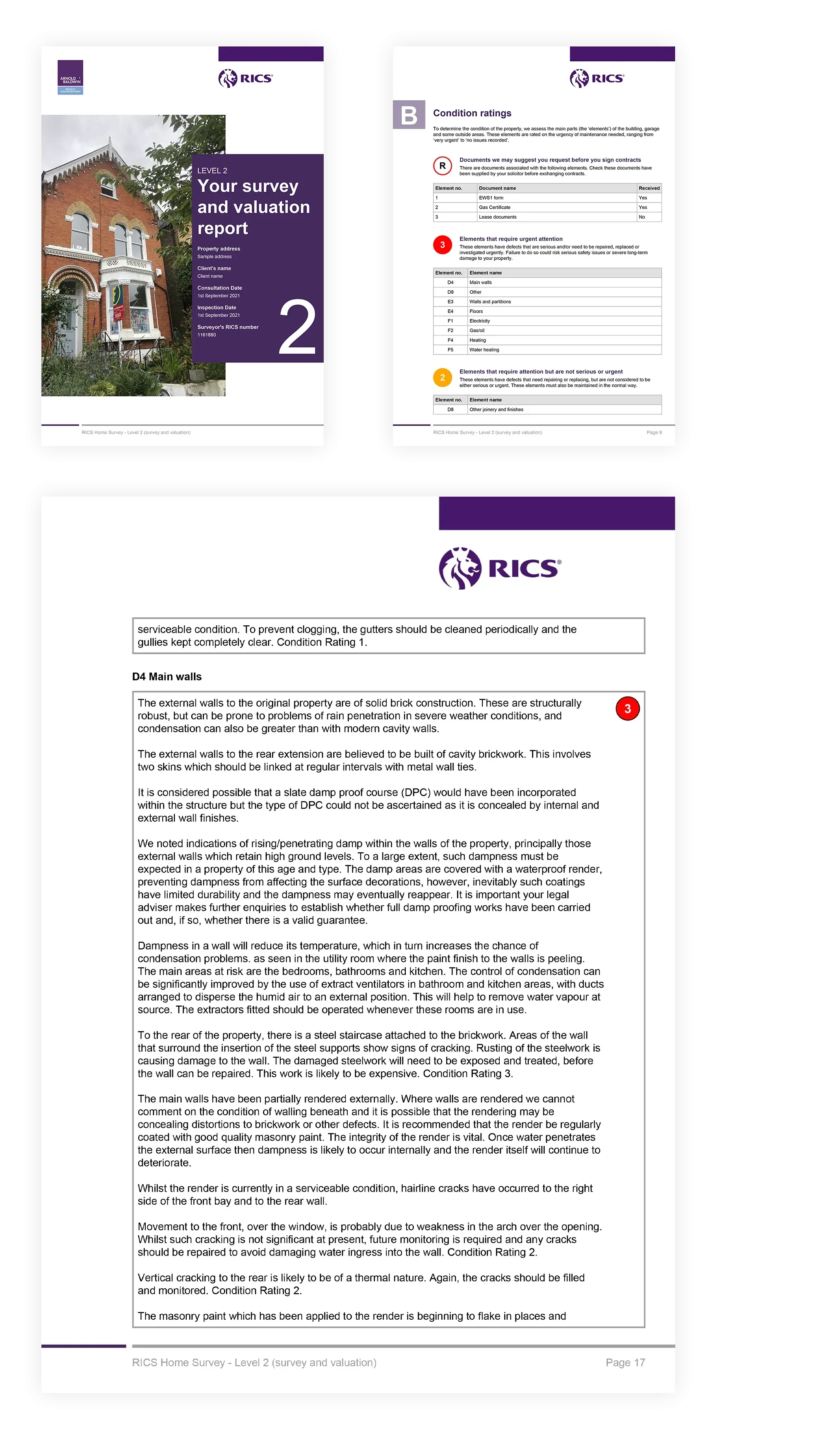

HomeBuyer Report

Intermediate property survey with optional market valuation included

This is a comprehensive property survey giving everything you need to make an informed decision about your property purchase - including a market valuation.

Our HomeBuyer Report includes:

Clear ‘traffic light’ ratings of the condition of different parts of the building, services, garage and outbuildings, showing problems that require varying degrees of attention;

A summary of the risks to the condition of the building; and other matters including guarantees, planning and building control issues for your legal advisers.

The surveyor’s professional opinion on the ‘Market Value’ of the property;

An insurance reinstatement figure for the property;

Any issues that the surveyor considers may affect the value of the property;

Advice on repairs and ongoing maintenance; issues that need to be investigated to prevent serious damage or dangerous conditions; legal issues that need to be addressed before completing your conveyancing

Information on location, local environment and the recorded energy efficiency (where available).

The price for a survey depends upon a few factors and you can get an estimate immediately by choosing your survey here.

If you wish to discuss your purchase in greater detail, please feel free to call us. We are happy to listen to your needs, answer your questions and advise on which survey we feel is most appropriate for you.

7. Start the sale process

This is where the rubber hits the road! When the conveyancing process kicks in, you’re nearly home and dry!

If you haven’t already, find and instruct a conveyancing solicitor. Most local solicitors will do conveyancing - which is the legal process of buying & selling a property. Getting the legal side of things in place as quickly as possible is essential to ensuring your purchase or sale goes smoothly.

The Law Society maintains a database of more than 200,000 solicitors across the UK.

We recommend visiting their website to find your conveyancing solicitor.

Once you’ve instructed your solicitor, they’ll get to work co-ordinating the purchase of your new home and the various professionals involved. There will be lots going on behind the scenes but a good solicitor will keep you in the loop. Milestones in the process include:

Making an enquiry to the lender.

Signing and return of the solicitors’ terms of business.

Agreement in principle issued by the lender

The lender will also get some of your basic information, perform a credit search and get your credit score before coming up with a figure that 'in principle' it will be able to lend you.

If you are selling a property, you will receive the ‘Fixtures and Fittings’ preliminary documents for completing.

If you’re selling and haven’t completed, ask us about SellSmarter!

Our SellSmarter services are designed to speed your sale, avoid costly delays and help to complete – quickly and confidently!

NOTE: Your solicitor requires these documents back to be able to issue your buyers with a draft contract. Most solicitors acting for a purchaser will not move forward until they receive the draft contract.

Full application made to lender and mortgage valuation carried out

You may also need to meet with your mortgage broker to provide ID and pay fees.

Your solicitor will also most probably ask you for funds for them to carry out the searches on the property.

Property searches (also known as conveyancing searches) are enquiries made by your solicitor to find out more information about a property you plan to purchase. As part of the home-buying process, your conveyancer will carry out a variety of 'searches' with the local authority and other parties.

Once the draft contracts have been received on your onward purchase, your solicitor will apply for the searches. The results typically take 7-10 working days to arrive.

Types of searches which will be conducted include:

Local Authority search

Giving you information on things like planning issues, roadworks, the proximity of railway or tube lines, and whether the property is listed or is situated in a conservation area.

Drainage and water search

To reveal matters such as the proximity of public sewers, whether there is a sewer running through the boundaries of your property, whether the property is connected to the main water supply, whether dirty water and surface drainage from the property drain into a public sewer and the location of the water mains.

Environmental search

Your conveyancer must make an assessment as to whether land contamination is an issue. Care must be taken to make sure environmental issues are considered where necessary, for example, if it is known that there is a landfill site nearby.

Planning search

To find out about possible development near the property you are thinking of buying.

Flood risk report

This will tell you what level of risk there is that the property might be susceptible to flooding. It takes into account risks from surface water, groundwater, coastal and river flooding. The report also tells you whether it is likely that the property will be insurable against on normal terms.

Coal mining, brine pumping, and other mining searches

These search results will reveal whether there is anticipated coal mining activity or whether there has been activity in the past. It will also show the existence of underground coal workings and mine entries which may cause problems with subsidence. It can also reveal whether any claims for compensation due to subsidence have been made.

Chancel liability search

If the property is situated near to a church, a chancel liability search should be carried out. The deeds will often reveal whether the owner is liable to contribute towards church repairs. However, this is not always the case and in the first instance, the seller should be asked this question when initial enquiries are made as chancel repairs can be very costly.

Land registry search

Your conveyancer will need to prove that the property seller is the legal owner of the property you are buying. They do this by checking the 'title register' and 'title plan' at the Land Registry.

Mortgage offer issued to solicitor & applicant

You will receive a copy of the sellers ‘Fixtures and Fittings’ preliminary documents. Take care to review these documents and raise any queries with your conveyancer.

NOTE: If you are purchasing a leasehold property, be sure to confirm the unexpired lease term.

DO NOT LEAVE THIS TO YOUR CONVEYANCER. Arnold and Baldwin are specialists in Lease Extensions so we can give expert advice, especially if you are concerned about a short lease and the potential cost involved in extending it.

NOTE: Your solicitor will send you a mortgage deed for signing. This will need to be witnessed by a professional person then signed and returned to your solicitor.

Your mortgage offer is only valid for a period of time – make a note of the expiry date and, should the purchase be delayed for an unexpected reason, you may need to apply for an extension.

Based on the results of the searches and the information provided in the ‘Fixtures and Fittings’ preliminary documentation your solicitor will raise enquiries.

It will be a condition of the mortgage offer for you to arrange Building Insurance in readiness of exchange. Once you have this in place, send a copy of the policy to your solicitor.

There may be a certain amount of back and forth between the solicitors until your representative receives answers that they feel are satisfactory. Don’t lose heart whilst you are waiting for the call from your solicitor to say they are ready for you to sign contracts.

We can help you to exchange within four weeks.

It’s possible with SellSmarter.

In the meantime, you can get your deposit ready to transfer. Typically, you are required to transfer 10% of the purchase price to your solicitor to enable the exchange to take place.

NOTE: If you plan to provide your solicitor with a cheque for this amount they will need to wait until it clears to exchange. Also, if you are being ‘gifted’ this amount, ensure the funds are in your account ready to transfer.

When your solicitor is ready, they will compile a final report for you to review. This will either be posted to you, or your solicitor will arrange an appointment to review the documents face to face. If you are happy with the solicitor's findings you will be asked to sign contracts ready for exchange.

If you are selling a property your contracts can be signed much earlier in the process. Ensure this is done so when the time comes you are not the one holding up proceedings!

Once a completion date (move date) has been agreed, contracts have been signed and received and the deposit has been received, you are ready to exchange!

Phew! The procedure for buying a house can be lengthy and complicated, but ultimately it’s worth it. Plus, if you’ve got the right survey and acted on the advice of your solicitor, you should enjoy a smooth move – and your new home - from the outset.

Up next: If you're still not sure which survey to choose, ask us! We can explain the differences and help you assess which one is applicable for you and your potential property.