Article

April 30, 2025

Property related articles, FAQs, reviews, careers and training for your reading pleasure.

Do you have great property content and would like to feature on our site? Please contact marketing@arnoldandbaldwin.co.uk

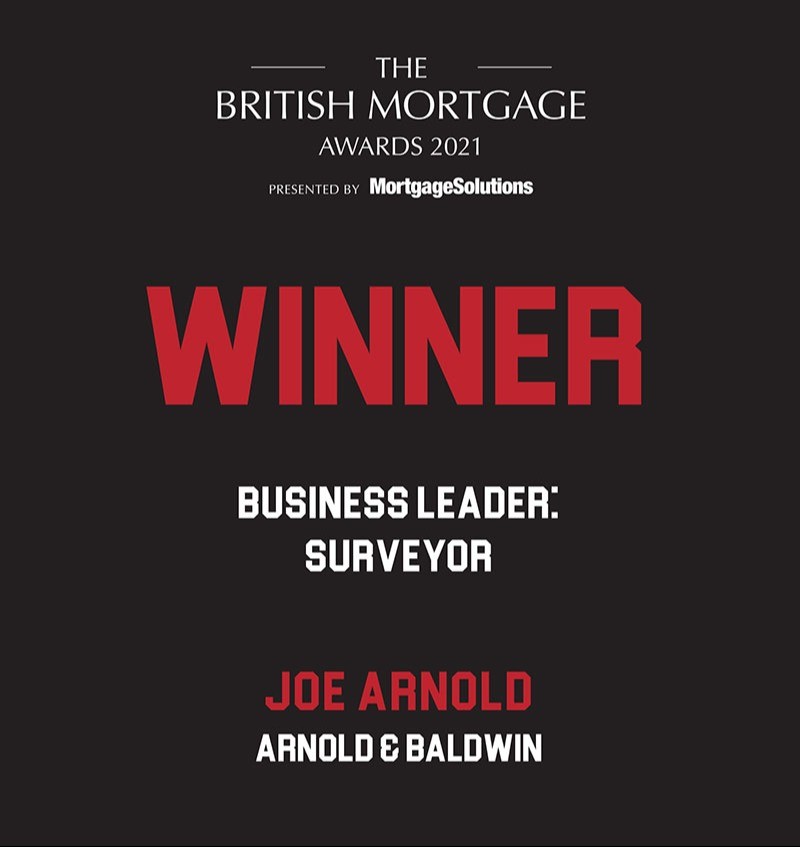

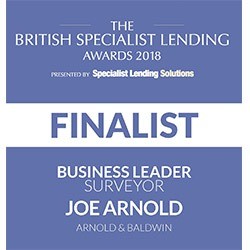

Whether it's your building, property or home, our award-winning property experts can help

Our property experts are here to help you